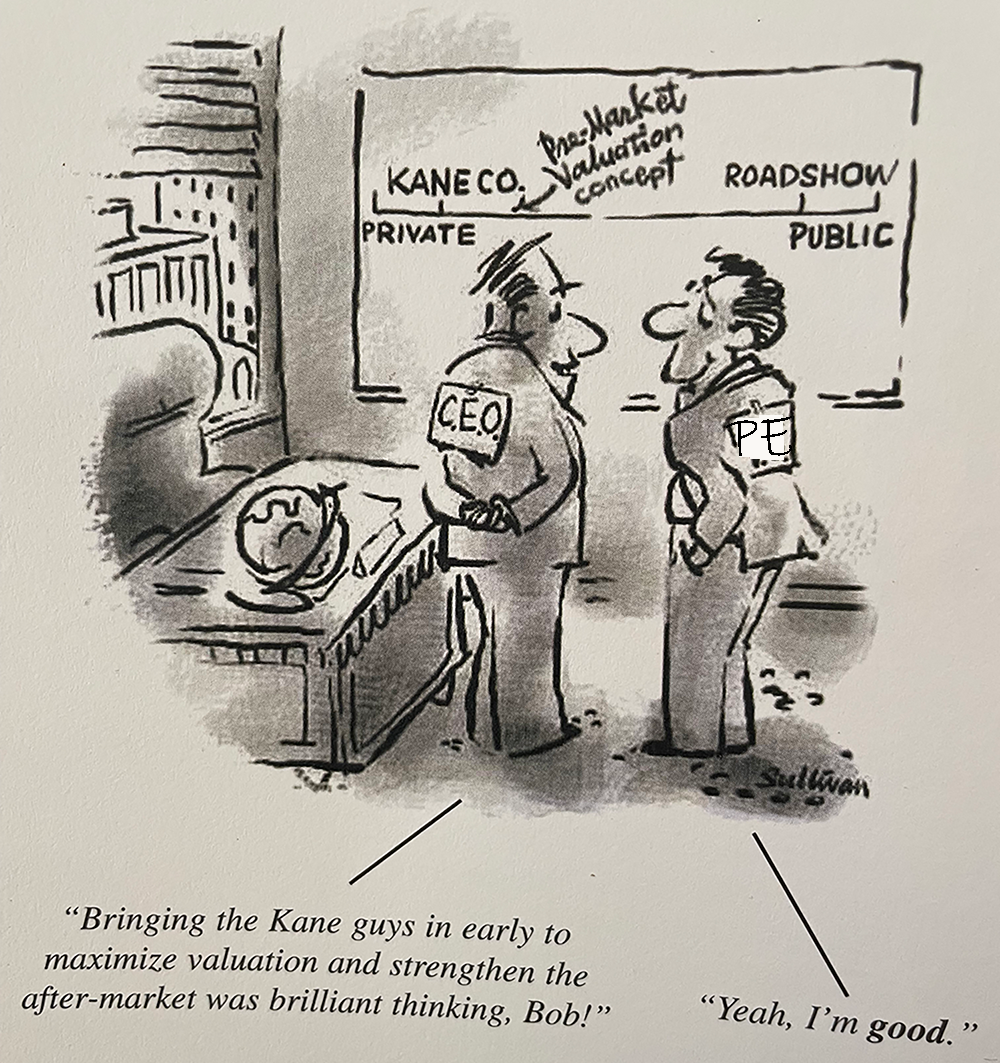

The Kane Independent IPO Underwriting Process Maximizes Value in traditional IPOs with Wall Street Underwriters

The Kane process empowers shareholders, working with all stakeholders, including private equity investors, to take control of their IPO value positioning to maximize valuation under existing market conditions, defending that value against all due diligence challenges and organizing and controlling the process.

Relying solely on your private equity sponsor "to handle the IPO" because they have on staff a person who was "an analyst/associate/VP at Goldman," is like relying for your IPO yield on former apprentices who brought wood to the oven and pumped the bellows where the master blacksmith forged metallurgical masterpieces - qualitatively an inference of equivalence insulting to the master blacksmith (Managing Director) and a material disservice to you.

Schedule 15 min to see if We are RIGHT for YOU

With Kane in your corner, you can anticipate, understand, and control the business implications of the critical IPO issues and decisions.

At Kane we emphasize practical strategic and tactical decision-making to maximize valuation, create a liquid, well-supported after-market and to anticipate and control transaction risk and cost.

- Value Accretion - proper positioning by Kane realizes millions in market value.

- Value Preservation - Our empirically-based due diligence defense can save millions more.

- Control of Cost and Risk - Kane Professional Project Management puts you in greater control to streamline costs, increase efficiency and stay on schedule.

- After-Market Maximization - A reliable, liquid, public after-market for your company's securities.

The Kane Difference: Kane is an "unbundled" provider of corporate finance, M&A, capital markets and underwriting services. We do not have competing sales, trading, research or asset management agendas - which means we ONLY REPRESENT YOU, and NEVER investors in your IPO. In other words, we have no competing business incentive to rush, structure or arrange for the distribution of your securities other than as benefits you. You get the best of everything: the best planning and preparation from us, and the very best lead-managing underwriters the Street has to offer for your particular transaction, because if you are doing a traditional underwriting, we recruit the best for your deal. (If you are going public via SPAC, except on the broadest dimensions of quality, there is less to distinguish among underwriters - but after-market support immediately post-IPO remains VERY relevant, and whether the underwriters have analysts that can competently follow whatever company you merge in - is critical for sustaining value-positioning in the after-market.

Schedule 15 min to see if We are RIGHT for YOUPublic and Private Transactions

Business Sales, IPOs, Fairness Opinions, Acquisitions, Restructurings

Schedule 15 min to see if We are RIGHT for YOU